Amendment Sixteen to the Constitution was ratified on February 3, 1913. It grants Congress the authority to issue an income tax without having to determine it based on population. The official text is written as such:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

In the Constitution’s original writing, the Taxing Clause in Article I grants Congress the general authority to “lay and collect Taxes, Duties, Imports, and Excises.” For “direct” taxes, Article I commands that they must be collected based on the population of the states. Before an income tax was established, the majority of funds given to the federal government derived from tariffs on domestic and international goods. The short-lived Revenue Act of 1861 predated the Sixteenth Amendment as the first official federal income tax, but it was eventually repealed in 1872. The end of the 19th century saw the beginning of the Progressive Era, a time period in which political and social reform centered on industry, voting, immigration, and several other topical issues of the time period. Levying a federal income tax became a key goal for many progressive groups, the key argument being that it was fairer for wealthy individuals to pay for the taxes and tariffs that had been largely obliged from the middle class and the poor in society. Congress passed the 1894 Wilson-Gorman Tariff Act, which contained an income tax provision of 2% on incomes of over $4,000 (equivalent to $135,951.63 in 2022 U.S. Dollars). Supporters of this new income tax argued that it was not specifically a “direct” tax, which would require it to be apportioned among the states. Two previous Supreme Court decisions supported this theses, but the 5-4 decision in 1895’s Pollock v. Farmers’ Loan & Trust Co. ruled that the income tax in the Act was a “direct” tax. The core argument was that the income tax in the Act was sourced from deriving income from an individual’s property. Based on this, the Court asserted that “direct” taxes included any sort of income tax on rents, dividends, and interest, therefore making them legally required to be apportioned among the states.

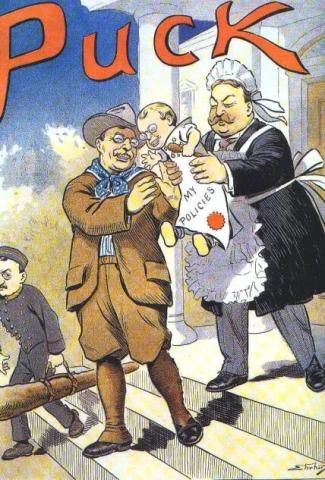

Fourteen years after the Pollock decision, President William H. Taft proposed to Congress a new income tax of 2% on corporations. This would be imposed by an excise tax on manufactured goods and an amendment to the Constitution to legally sanction the most recent federal income tax. Several conservative senators proposed different versions of the new amendment throughout 1909. Many citizens living in the West and the South supported an income tax on the grounds that it would be an easier way to raise funds on those less well-off. Several key Republicans, including former President Theodore Roosevelt, began to believe that the new amendment’s income tax would be good to help finance the United States’ increasing political and military power. These “insurgent” Republicans – many of whom would go on to create the “Bull Moose” Party – stood in opposition to the establishment Republicans in Congress. Their opposition to the new amendment was largely rooted in their connections to major businesses of the time period, while others argued that an income tax would make the federal government more powerful and centralized. The rise of the Progressive Party and the victory of the Democratic Party in the 1912 Presidential Election allowed for an easier ratification phase of the new amendment. From 1909 to 1913, the new amendment was ratified by the required thirty-six states out of the then forty-eight. On February 3, 1913, just one month before the inauguration of President Woodrow Wilson, the Sixteenth Amendment was formally accepted into the Constitution. With the income tax provision outlined in the new amendment, the Revenue Act of 1913 was soon after enacted into law by Congress. The most significant long-term impact of the Sixteenth Amendment was the shift in the way the federal government received funding for its works. What was originally conceived as a system that depended largely on tariffs at a level just slightly above the many states, transformed into a more powerful, centralized institution that sourced vast quantities of funding through the many incomes of individuals and the states.